Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

- Expenses can be paid immediately with cash, or the payment could be delayed which would create a liability.

- A limited liability company means if the company fails, the partners are on the hook for only what they initially invested in the company.

- Liabilities are incurred in order to fund the ongoing activities of a business.

- One is listed on a company’s balance sheet, and the other is listed on the company’s income statement.

- A company may owe this payment to creditors, lenders, banks, or other financial institutions.

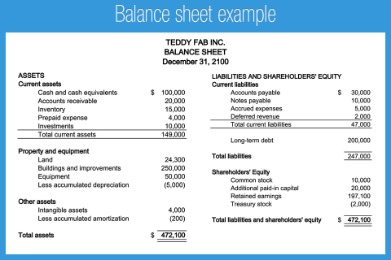

- Liabilities expected to be settled within one year are classified as current liabilities on the balance sheet.

Long-term debt, also known as bonds payable, is usually the largest liability and at the top of the list. These are the liabilities that may https://kelleysbookkeeping.com/top-12-weirdest-tax-rules-around-the-world/ take place depending on the outcome of a future event. These liabilities are not sure to occur, meaning that they may or may not happen.

Words Ending With

It can be real (e.g. a bill that needs to be paid) or potential (e.g. a possible lawsuit). For example, many businesses take out liability insurance in case a customer or employee sues them for negligence. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Assessing Overlapping Boards After DOJ Crackdown // Cooley … – Cooley LLC

Assessing Overlapping Boards After DOJ Crackdown // Cooley ….

Posted: Thu, 25 May 2023 20:35:03 GMT [source]

Expenses are the costs of a company’s operation, while liabilities are the obligations and debts a company owes. Expenses can be paid immediately with cash, or the payment could be delayed which would create a liability. Liabilities are important to notice because they help gain an idea about the net revenue of a company. By subtracting, liabilities from the total shareholders’ equity one can gain an insight into the current liability which shows the net gain.

What are liabilities?

They also help create capital structure and give a snapshot of the liquidity of the company. Long-term debts are important indicators of the long-term solvency of a company. Liabilities help determine long-term debts and hence help the company maintain the long-term solvency of a firm.

As there is a chance of not occurring in the future, these debts are considered in accounting records only if the probability of occurrence of the debt is more than 50%. Government probes, outstanding lawsuits, liquidated damages, and product warranties are good examples of contingent liabilities. Companies will segregate their liabilities by their time horizon for when they are due.

What is a Liability?

This can help companies decide on their capital structure and the debt component. That is why liability is considered indispensable to gaining a proper view of the company’s financial health. The liabilities component of the balance sheet helps businesses increase their value creation and organize business operations processes.

Like businesses, an individual’s or household’s net worth is taken by balancing assets against liabilities. For most households, liabilities will include taxes due, bills that must be paid, rent or mortgage payments, loan interest and principal due, and so on. If you are pre-paid for performing work or a service, the work owed Liability Definition And Meaning may also be construed as a liability. Considering the name, it’s quite obvious that any liability that is not near-term falls under non-current liabilities, expected to be paid in 12 months or more. Referring again to the AT&T example, there are more items than your garden variety company that may list one or two items.